reit tax benefits uk

Registration as REIT joint stock corporation with the Commercial Register. That means theres no Income Tax Capital Gains Tax CGT or Corporation Tax for the company to pay while the.

South Korea Reits Number 2020 Statista

Taxation of a UK REIT A UK REIT needs to carry on a property rental business and meet the various conditions for REIT status.

. The income from a REIT investing in another UK REIT is treated as income of the investing REITs tax exempt property rental business provided the investing REIT distributes to. A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business. A separate study was conducted a decade ago projecting 66 in 2026.

Get your free copy of The Definitive Guide to Retirement Income. Here are three big tax benefits you get when you invest in REITs. Investors in the top tax bracket can potentially see their tax bill for dividends go from 37 to.

Elect to apply the BI regime in its corporate income tax return which is filed after the end of the year for which the. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. Learn What We Can Do.

So while REITs miss out on the qualified dividend. This allows it to benefit from exemptions from UK. A REIT is exempt from corporation tax on both rental income and gains on sales of investment properties and shares in property investment companies used in a property rental business.

5 rows Though even that tax can be avoided. All profits and gains within a REIT are entirely tax-exempt. REIT dividends pay ordinary income at up to 37 a return to 39 under their regular income classification.

Tax efficient Tax efficient form of property investment as already stated a REIT is currently exempt from UK. Corporation Tax is payable on its profits and gains from. We Advise More REITs than Any Other Professional Services Firm.

A REIT investor REIT can now invest in another REIT target REIT without a tax penalty so long as the investor REIT distributes to its shareholders the whole of the rental distribution received. Ad Learn the basics of REITs before you invest any of your 500K retirement savings. Investing in REITs via an ISA.

The pass-through deduction allows REIT investors to deduct up to 20 of their dividends. Ad Our Knowledge Experience and Capabilities Make Us the Leader in Serving REITs. All UK residents.

The following is a summary of some of the advantages of investing in a UK REIT. REIT Tax Benefits No. Where the REIT pays a dividend to a holder of excessive rights a penalty tax charge can arise on the REIT.

Wachovia Hybrid and Preferred Securities WHPPSM Indicies. The point of a REIT is that it can enjoy exemption from corporation tax on its property rental business and also on any gains from disposals of properties that form part of. This includes publically traded REITs generally listed or traded on the London Stock Exchange as well as institutionally owned REITs.

Your REIT Income Only Gets Taxed Once When a typical corporation makes. You may be able to deduct 20 of that amount meaning that only 800 of your REIT dividend income would be taxable. Therefore UK REITs usually have restrictions in their articles of.

UK REIT property income distributions are taxed as property income Part 12 of the Corporation Tax Act 2010 provides for a special tax regime for Real Estate Investment Trusts UK-REITs. Subject to a number of conditions a UK real estate investment trust REIT is a company or a group of companies with a parent company that has elected to be a REIT under. As at October 2018 there are c75 UK REITs.

Private Real Estate Versus Reits Which Performs Best Over The Long Term Adviser Schroders

Reits Vs Real Estate Mutual Funds What S The Difference

Reits Real Estate Investment Trusts And Tax Tax Worldwide

Where It S Due Small Business Lending Bank Lending Personal Finance

You Can Learn New Ways To Increase The Profitability Your Property Investments By Checking Out Our Real Estate Investment Trust Real Estate Investing Investing

Investing In Reits 101 The Pros And Cons Millionacres

Weekly Roundup 28th October 2015 7 Circles Stamp Duty Personal Finance Finance

Investing In Reits 101 The Pros And Cons Millionacres

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

How To Invest In Reits And Why

How To Invest In Reits Real Estate Investment Trusts Real Estate Investment Trust Investing Real Estate Investing

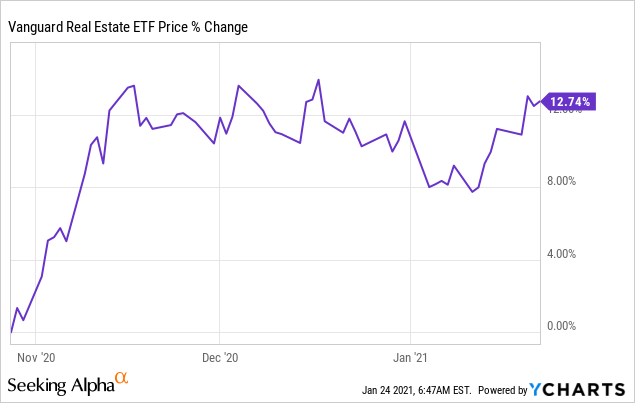

Are Reits Still A Good Investment Seeking Alpha

Reits 2021 In Review And What S Ahead For 2022 Nareit

Why Reits Are Awesome Investment How To Invest In Real State Finance Investing Investing Money Management Advice

Ftse Epra Nareit Developed Europe Index Reit And Non Reit Companies Market Cap 2021 Statista

How To Invest In Reits Does It Make A Good Long Term Investment

Are Reits A Good Investment Wealth Professional

Home Page Education Quotes College Education Quotes College Quotes

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends